By Dante Atkins for Daily Kos Sun Oct 23, 2011

It's an old adage often used to compare Republican discipline with Democratic disarray: when you ask a million people what Democrats stand for, you'll get a million different answers. But if you ask those same million people what Republicans stand for, you'll often hear the same three things: small government, low taxes and a strong national defense. For anyone who has been paying attention, however, the Republican commitment to these principles has been waning at best. The Republican commitment to small government and local control was swept aside under President George W. Bush's unprecedented arrogation of executive power and evaporated completely when Gov. Rick Snyder of Michigan decided to eliminate the local autonomy of cities in pursuit of his union-busting agenda. The Party's one-time monopoly on issues of national defense has been crushed under the weight of the costly misadventure in Iraq and the increasing lack of success in Afghanistan; President Obama, meanwhile, has more than done his part in eliminating that narrative through his risky decision to strike at Osama bin Laden and his steady hand in navigating the U.S. and NATO through the revolutions of the Arab Spring.

Taxes, however? This was the Republican Party's signature agenda: the idea that tax rates should be low across the board. That it's your money, and you should keep it. The idea that people know how to spend money better than the government goes. Historically, this has been a winning message: most voters will always appreciate the thought of more money in their pockets, especially when they keep on being told that the tax cuts they're getting will actually pay for themselves. But just like their messages on limited government and a strong defense, the Republican commitment to low taxes is beginning to slip—just, not in the area that a decent respect for the opinion of mankind might cause one to expect.

This week's news on Republican perceptions of taxes shows nothing out of the ordinary. It comes as no surprise that the economic injustice that is fueling the Occupy Wall Street movement is also making President Obama's populist policy on tax increases very popular. Obama is pushing aggressively for tax increases on the wealthiest Americans to fund a jobs program that will rebuild American infrastructure and put unemployed Americans back to work. Karl Rove, pursuing his party's rigid anti-tax orthodoxy, is spinning furiously to undermine it.

This is the Republican Party we have all come to expect: the party that will fight against any tax increases, no matter how sensible, no matter how fiscally constrained the budget is, simply as a matter of orthodoxy. But you might have heard another number being bandied about recently: the "fact" that 47 percent of Americans pay no taxes. Now, if we ignored payroll taxes, sales taxes, excise taxes and all other forms of taxes besides federal income taxes, that would be true. But for an anti-tax Republican, the idea that nearly half of all Americans pay no income taxes should be a welcome statistic; it would mean, after all, that we're nearly halfway toward ensuring that no Americans pay federal income taxes at all.

But no. Far from being a source of pride for the party of low taxes and limited government, this is a source of consternation, and the Republican presidential field will not tolerate this sort of injustice. Here's erstwhile frontrunner Gov. Rick Perry:

“We’re approaching nearly half of the United States population that doesn’t pay any income taxes,” he responded. “And I think one of the ways is to let everybody, as many people as possible, let me put it that way, to be able to be helping pay for the government that we have in this country.”

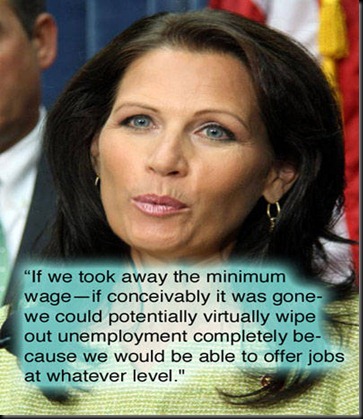

The now-imploded Rep. Michele Bachmann struck up a similar theme:

“Part of the problem is today, only 53% pay any federal income tax at all; 47% pay nothing.” She added, “We need to broaden the base so that everybody pays something, even if it’s a dollar.”

And the likeliest of the Republican presidential candidates, Gov. Mitt Romney, is not exempt from this sudden urge to raise taxes on middle- and lower-class Americans:

“We want to make sure people do pay their fair share. Half the people in this country pay no income tax at all."

The difference with Romney, of course, is that in his next breath, he added that he does not want to raise taxes on the middle class, leading to the inevitable conclusion that either Romney wants to raise taxes on the poor, or he is contradicting himself. But by far the most egregious example of the GOP's breach on taxes comes from pizza mogul Herman Cain.

If any newspaper reporting on the GOP presidential race were looking to fill extra column inches, they would need to look no further than this obscenely long graph that demonstrates the difference in average household tax liability by income bracket under Cain's proposal. The visual from the Tax Policy Center estimates that the bottom 80 percent of Americans would see significant increases in their household tax liability under Cain's plan, while the top tenth of a percent would see decreases in the same that are beyond belief. Cain's proposal, in a nutshell, is to cut taxes for the rich and make the poor pay for it—a plan that falls right in line with his fellow candidates' agreement that more people need to pay taxes, as well as Karl Rove's position that it most certainly won't be the wealthiest who do.

When all four of a party's presidential candidates who have held leads in national polls advocate for raising taxes on the poor and middle class, that party can no longer call itself opposed to taxes, no matter how fervently they try to oppose President Obama's popular proposal to ask more from those who are best off. The Republican Party is no longer the party of lower taxes. Instead, it has transformed itself into a cult of Ayn Rand's objectivism, where so-called "producers" are rewarded with favorable policy outcomes and the "parasites" are punished for their lack of work ethic. In Herman Cain's America, after all, you only have yourself to blame if you're unemployed. And in Mitt Romney's America, the best way to solve the foreclosure crisis is to turn people out of their homes faster so investors can make a quicker profit off of buying them.

Who is John Galt? And more importantly, what has he done with the Republican Party?