By David Waldman

Back in January, we discussed a little bit Mitt Romney's life as a locust capitalist.

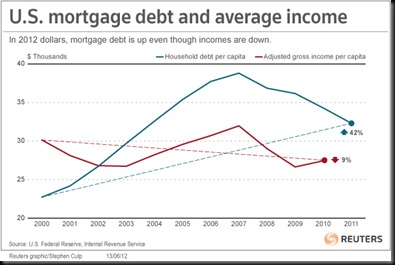

And on Wednesday, we discussed an interesting chart that told the story of how the workers who actually performed the labor behind a remarkable and history-making increase in productivity were left behind when it came to sharing the fruits of that increase.

So I've been thinking about revisiting the topic of just how Romney managed to keep making so much money from companies that, in many cases, ended up failing.

From Florida's Broward Palm Beach New Times, helpfully titled, "Mitt Romney and Bain Capital Represent Everything You Hate About Capitalism."

So yeah, it's largely like I said it was in January. Romney borrows money to buy a majority stake in a company, takes over its board of directors, and uses that position to vote Bain a fat management contract, and take out the biggest loans possible from the company's bank. That money goes to pay back the people who put up the money for the purchase, as well as giant bonuses for Bain managers. But now the company has a huge debt to the bank (the interest on which is, of course, tax deductible), which the Bain managers sorta-kinda attempt to pay back by cutting payroll, benefits, investments in equipment, etc. Basically anything they can find to transfer the pain to anyone other than themselves.

Thanks, Secretary Reich! Beautiful job!

And now you know something about the mechanisms that produce economic insanity like this:

From 1978-2011, CEO compensation increased more than 725% while worker compensation grew 5.7%. #Budget #ows

— @SenSanders via web

So, yeah. What that means is that not only is Romney not a "job creator," he's not a even really a "businessman," either. He's a financier, but he knows that's always been kind of a dirty word. So it's "businessman," or "entrepreneur," or... "job creator."

To a financier like Romney, what a business does, and who does it, doesn't matter. He's in it for the money. Specifically, taking money from other people.

And as the video now makes clear, the "business" theory of "businessman" Romney is first and foremost that all businesses are the same. You'll notice that Secretary Reich never even has to mention what's being made. What a company makes is of no concern to Romney, except insofar as the infrastructure built up by the original owners around the process of making it can now be used as collateral for loans Romney never really needs to worry about repaying. The company, to Romney, is nothing more than a vessel full of money to be moved and extracted. That it might make something or provide some service—and employ thousands of people who make a living from doing it—is merely incidental.

A real "businessman," as we're traditionally meant to understand it, wants to make a good product for it own sake, and take profit from other people's appreciation for its quality and value. But that's not and never has been what Romney's "business" has been.

The business experience Romney has is finding ways to make the work of others pay for him. That's not the kind of experience in building for a nation and a people that we're looking for in a president. And it puts a frightening new spin on the old Republican saw about running a government like a business. Running a government like a business, to Romney, would mean finding ways to make the work Americans do worth more money to its president. And that has nothing at all to do with the concept of America that most people have. (It used to be that I would have felt more confident saying nobody thought of America that way, but things have changed.)

What we need is a president who can find ways to make our government worth more to the Americans it serves. That's the social contract. Can Obama do that? Can any president do it? I don't know. But I know I'd rather elect someone who's not ideologically opposed to trying.

But forget running government like a business. Romney doesn't even really know how to run a business like a business. He knows how to run a business like an investment, but that's a very different thing. Anyone who's ever worked for a company that was doing fine, if not exactly going gangbusters, but went sour once bought out by venture capital can tell you the difference in how they run. It's an all too familiar story these days. It's familiar because it happens a lot, and it happens a lot because it's worth a lot of money.

Not only did Romney run businesses only as investments, they were short term ones. He didn't actually have to try to extract value from profit, because buying a majority stake in the company and putting his people on the board of directors meant he could extract his profit right away, from the company's credit. Profits weren't necessary.

And when there was no more credit to be exploited, Romney extracted value from the company's assets. Either from the workforce, whose payroll and benefits he cut, or from deferring equipment upgrades, closing plants, etc. Profit-making for the companies never really had to be a concern. But if you could show one on paper by imposing what amounted to company-wide austerity programs for the workers (even as Bain executives took huge, credit-financed bonuses), then the option of flipping the company rather than just bleeding it dry remained viable. Which is always nice.

What it comes down to is that Romney didn't really run businesses. Running a lemonade stand is running a business. Buying one and telling them to eliminate the lemons and send you a check for the difference is not. He wasn't running businesses so much as taxing them privately, by forcing those he bought to pay Bain "management fees" for the privilege of being told how to do their jobs by MBAs who did not, themselves, have any idea how to do it. And the fees were payable even if they were being run into the ground. But, no, he didn't really run them. That's just a part of the image of the "businessman" label he's hoping to cash in on.

Now, it's not that Romney never invested with an eye toward growth. He sometimes did. Especially in the beginning, with the start-ups his campaign likes to talk about, like Staples and the Sports Authority. That's something Romney and Bain did when he could afford no more than a minority stake in a company. If he wasn't in complete control of how it spent its money, he had to take an interest in seeing a company become profitable, since that was the controlling factor in how much money he made from his minority investment.

But when Romney could afford a majority stake, the game became much easier to win no matter what happened. All he had to do was eat the muscle and sell the bones.

Or another way of putting it, to finally get around to justifying the title of this post, is that Romney was a businessman like the Hamburglar is a rancher. All the guy does is steal the burgers, gobble them up, and throw the wrappers on the ground. But here he is campaigning for president on the notion that his gluttony means he has experience in the beef business. Here he's been scarfing down burgers as fast as he can, and you're meant to think he's been painstakingly raising prize cattle.

Not only is it misleading to say he was a "job creator," he actually did everything he could to make it impossible to create any. Remember, Romney extracted his profit by draining the credit lines of the companies he bought. Credit lines are supposed to be how a company accesses the capital it needs to expand and create jobs, and here he was draining and pocketing them! The Romney/Bain model was pretty much what people used to call "eating the seed corn." Only now, it's what our our MBA-indoctrinated business class celebrates as "maximizing shareholder value." The profit comes from eliminating jobs, not creating them.

Romney, in other words, is hard-wired to do the exact opposite of what the country actually needs. In fact, he's ideologically opposed to it, because in his mind, the benefits of a booming economy belong to the investors in that economy, and he means the cash investors. If all you're doing is earning a paycheck, you're nothing but a drag on Mitt Romney's version of the economy. There's nothing he can do for you, nor is there anything he thinks he should do for you. He's incapable of helping people who don't bring cash to the table as investors. Sweat equity is not in his vocabulary. Romney simply doesn't believe in non-cash stakeholders. He rejects the concept. So if your investment in building something is actually, you know, building it, there are no future dividends for you. It's a cash transaction. You get the day labor rate, and that's that. All future benefits belong to the people who put in cash.

Is that a fair thing to do? Well, like the question of whether to call Romney a "financier" or a "locust capitalist, the answer lies mostly in which end of the pointy stick you were on. If you were on the dangerous end of the stick, Romney's a pirate. If he was wielding the stick for you, perhaps he's something more akin to a privateer. Remember those guys? They were "legalized" pirates, chartered by the state to take whatever prizes it could, so long as they were from "the enemy," whomever that might have been at the time. Of course, if the enemy caught you, your commission as a privateer was of no interest to them. They hanged you as a pirate, because that's what you were. Never mind what your fancy paper said. Of course you'd claim it was "legal" for you to steal for (and make payments to) the private financiers who paid to outfit your ship. Your government said so, and it was the financiers' money backing the government. And in many cases, they were the government. But the people you robbed couldn't care less why you did it. And if you were in their hands, the legal niceties didn't matter. They hadn't bought into that deal, so privateers hanged, and any justice due for hanging a privateer had to be extracted in open warfare.

Things have settled down a bit since those days, of course. Although Tony Soprano's practice of raiding a business's credit line isn't significantly different from Mitt Romney's, the boardroom bust out enjoys certain legal protections. Why? Well, the people who provide the bulk of the money it costs to run for and hold elective office know that without the latitude to exercise their "business judgment," even (and perhaps especially) when it's so poor that it ends up bankrupting the company and costing thousands of jobs while making them personally rich, they can't get as rich as they are. Which is to say, rich enough to continue to provide the bulk of the money it costs to run for and hold elective office. So in exchange for providing that money, they ask for and receive the state's commission as privateers, and leverage the state's monopoly on the legal threat of the use of force to run the bust out game, with sheriffs' deputies and U.S. marshals in place of the leg breakers.

As a "private citizen" (a heavily subsidized private citizen, but we allow him the label nonetheless), Romney operated as a privateer. His machinations were, at some level, not really your problem, though you were paying for them. You just didn't notice, and kicking up a fuss would upend too much of the system we'd just plain gotten used to, and which after all, did comfortably make sure that very day the sun rose, there were still 31 flavors available down at the Baskin-Robbins, my favorite consumerist metaphor for all being right with the world.

America's a nice place, and there's a certain amount of bullshit most of us are willing to swallow to keep it that way. The question underlying the Romney candidacy, though, is whether we're willing to take double rations so he can move up to emperor. Oh, and maybe just give his kids a go at running the same game in the meantime.

Things are fucked up and bullshit as it is. Let's not make things any worse.